After months of consultations and deliberations, Prince Rupert City Council has finally passed their 2023 Property Tax Rates Bylaw.

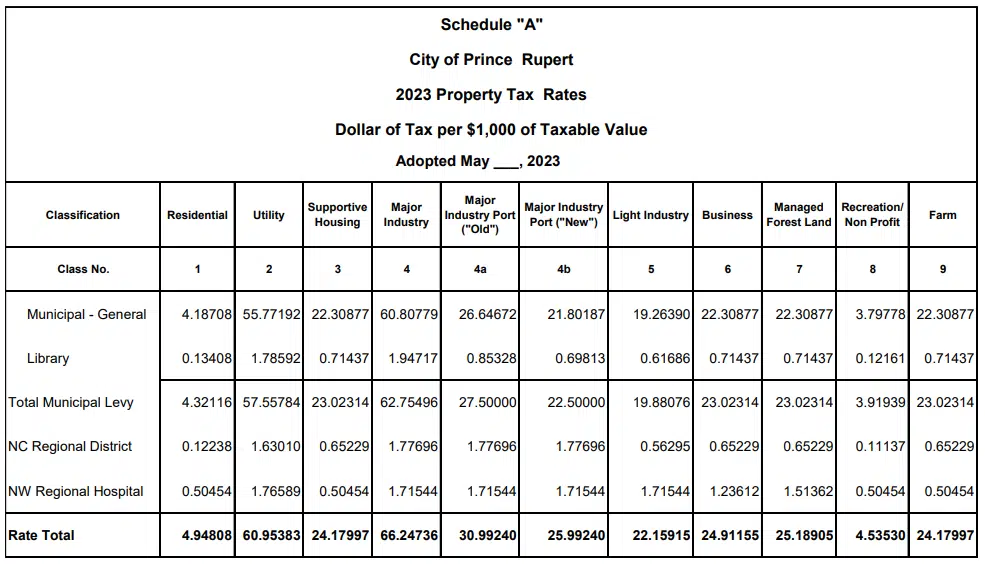

It locks in a municipal mill rate increase of 12.5 percent, meaning residential property owners will pay $4.95 per $1,000 of assessed value.

For the average Prince Rupert home, valued at $443,000, that will mean an increase of roughly $243 this year.

Most businesses will pay $24.19 per $1,000 of assessed value.

Council approved the increase alongside their 5-year financial plan, tagging total expenditures at just over $172 million for 2023.

Part of that includes the replacement of 26 kms of water and sewer lines, projected to cost $205 million over the next 3 years.

To help fund that, Council also gave the first three readings to a loan authorization bylaw relating to the project.

If approved, it will allow council to borrow up to $5 million for design planning, and $40 million to replace water waste infrastructure.

Last month, the Province provided $65 million for the project, and the City has applied for equal funding from Ottawa.

Comments