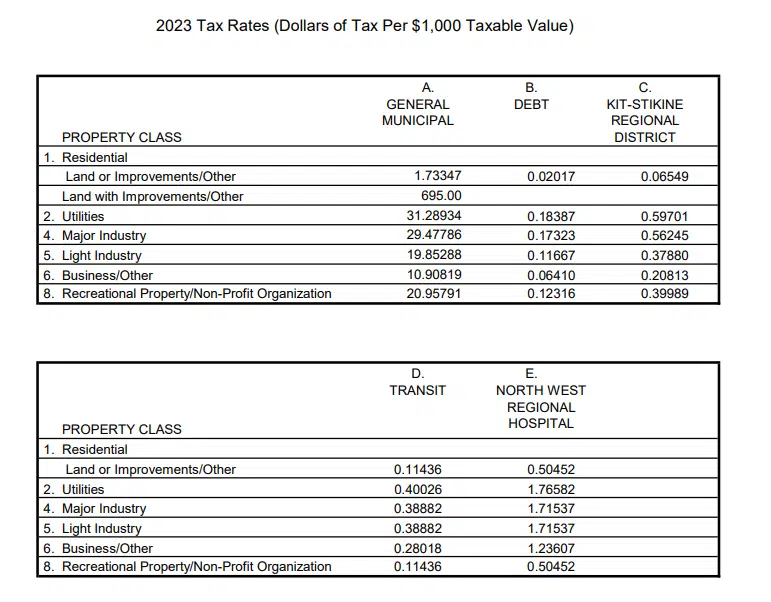

Kitimat Councillors have voted to adopt the District’s 2023 Tax Rates Bylaw and keep their residential flat tax charge in place.

Municipal property taxes for the District are collected through two methods, the flat tax, plus a standard mill rate similar to other communities.

But by keeping the flat tax system in place, the District is helping to ease the tax burden on lower-valued residential properties.

For 2023, the rate will remain at $695, on par with last year’s rate, plus an additional $2.43 per $1,000 of assessed value.

That means that the owner of an average residential property in Kitimat, valued at $345,000, will pay roughly $1,540 in municipal taxes in 2023.

Property taxes will contribute to roughly 80 percent of the District’s total revenue in 2023, earmarked at just over $45 million.

Comments