Nisga’a Nation members who wish to make use of their tax exemption on other Nation’s reserves will need to apply for a new status card.

Last year, Ottawa announced they would be restoring Section 87 tax exemptions initially given up by Nations when signing a Modern Treaty.

While the Nisga’a Lisims Government has yet to decide whether or not to keep their existing tax arrangements, the new rules will apply to other Nation’s reserves and former reserve lands.

But, current Nisga’a status cards are printed with a line stating that the holder is not entitled to the federal tax exemption.

Members in New Aiyansh can contact Sherry Wright at 250 633 3100, and those in Gitwinksihlkw should reach out to Ethel Nyce at 250 633 2294.

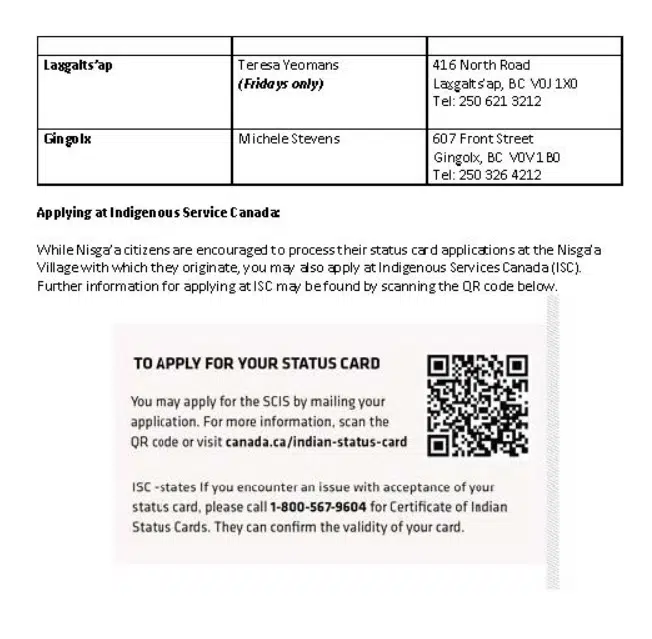

Applications must be made either through a Village Government or directly with Indigenous Services Canada, as the NLG can not process status card applications.

Exemptions will still not apply on Nisga’a lands until the NLG makes a final determination on their taxes.

Comments