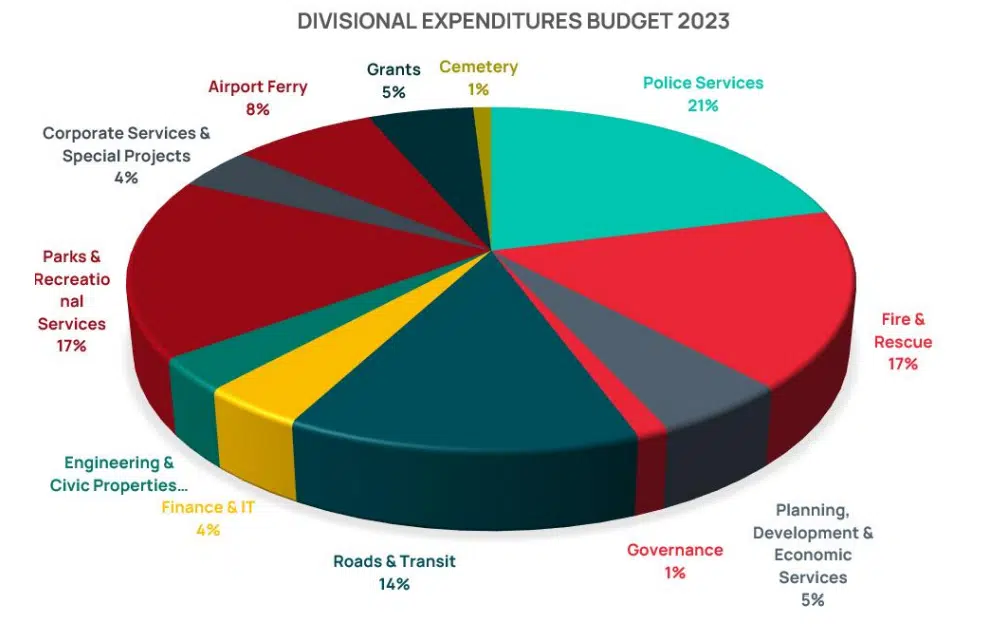

Prince Rupert residents are looking at a proposed property tax increase of 15.7 percent, according to the City’s 2023-2027 draft budget.

That compares to a 4.13 percent net increase over the past 7 years, and works out to an annual increase of $282 for the average homeowner.

Unlike other levels of government, municipalities can not operate in a deficit, and must balance their budgets each year.

But the City is projecting a shortfall of nearly $3.4 million just to maintain normal services and operations.

While the City says their internal costs are similar to what other Northern communities are facing, external impacts have bumped the increase.

Those include: the devaluation of undeveloped lands held by the Port Authority, the controversial Port Tax Cap, and reduced payments in lieu of taxes from the Port.

Increasing national inflation, and contract negotiations with multiple unions are also contributing to the higher than normal increase.

Presented to City Council last night, the budget must still go through public consultations before it can officially be approved.

Two public feedback sessions are being held at City Hall on April 11th and the 24th at 7:00 in the evening.

Residents can find the full budget at this link, and can email written submissions to finance@princerupert.ca through April 24th.

A budget simulation tool has also been made available by the City, and can be found at this link.

Comments