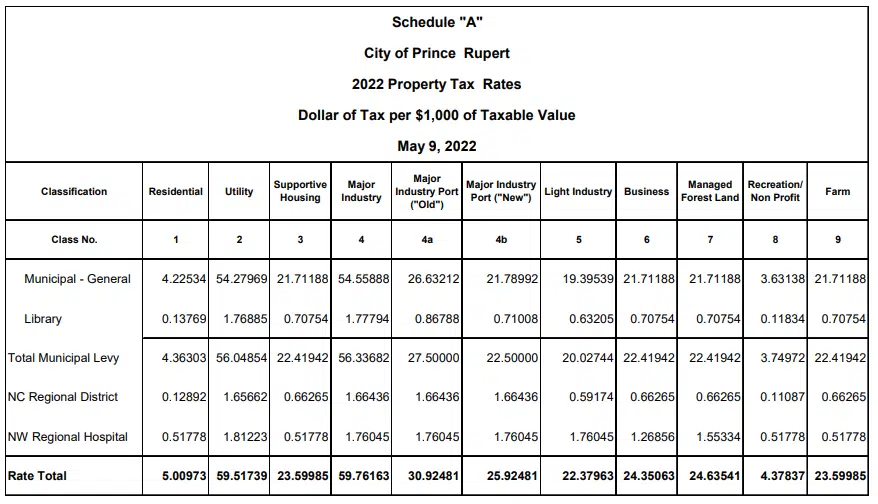

Prince Rupert City Council have adopted their 2022 Property Tax Bylaw, locking in the municipal rate for this year.

For residential property owners, that rate comes in at $5.01 per $1,000 of home assessment value.

That total includes the Regional District and Hospital taxes, and means the average home owner will see a roughly $144 rise in municipal levies.

Most businesses will pay $24.35 per $1,000 of assessed value, with a complete list of all property types below.

Only a portion of the overall property tax load is municipal, with the remainder coming from the province.

Comments